Two Communities. One Choice.

Get To Know Us

Founded in 1999 by the Episcopal Church Home and Affiliates Inc., both Canterbury Woods communities are mission-focused and not for profit.

Life Care

With assisted living, memory care, skilled nursing and rehabilitation available, we have you covered if health needs change.

Financial Gauge

Find out if independent living or our other living options are a financial fit for you.

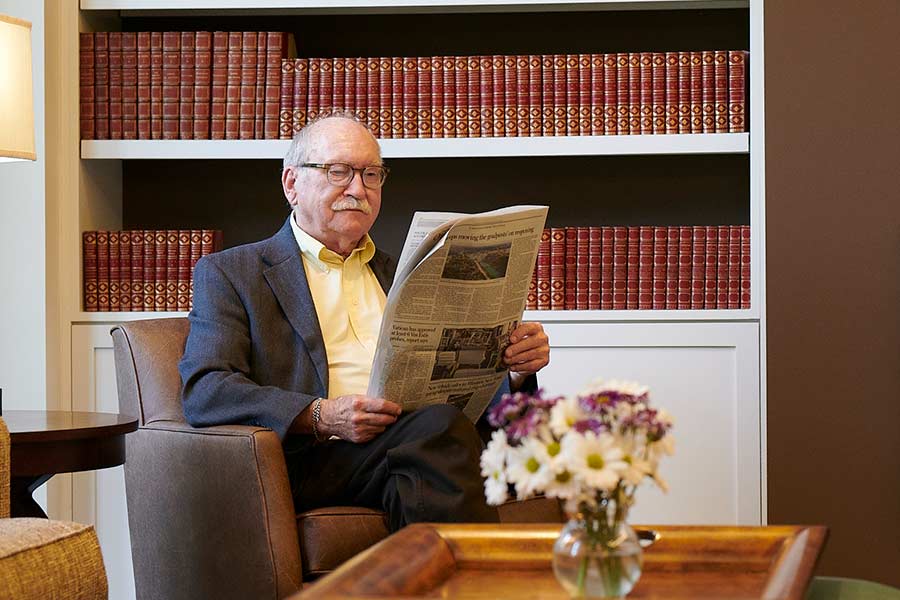

Every Picture Tells a Story

The best way to get a feel for our independent living options and learn about our continuum of care is to come for a personal visit. Meet our incredible residents, chat with our staff and get a real glimpse of daily life. In the meantime, enjoy the next best thing. Explore our photo gallery.

Schedule a Tour Today

"*" indicates required fields